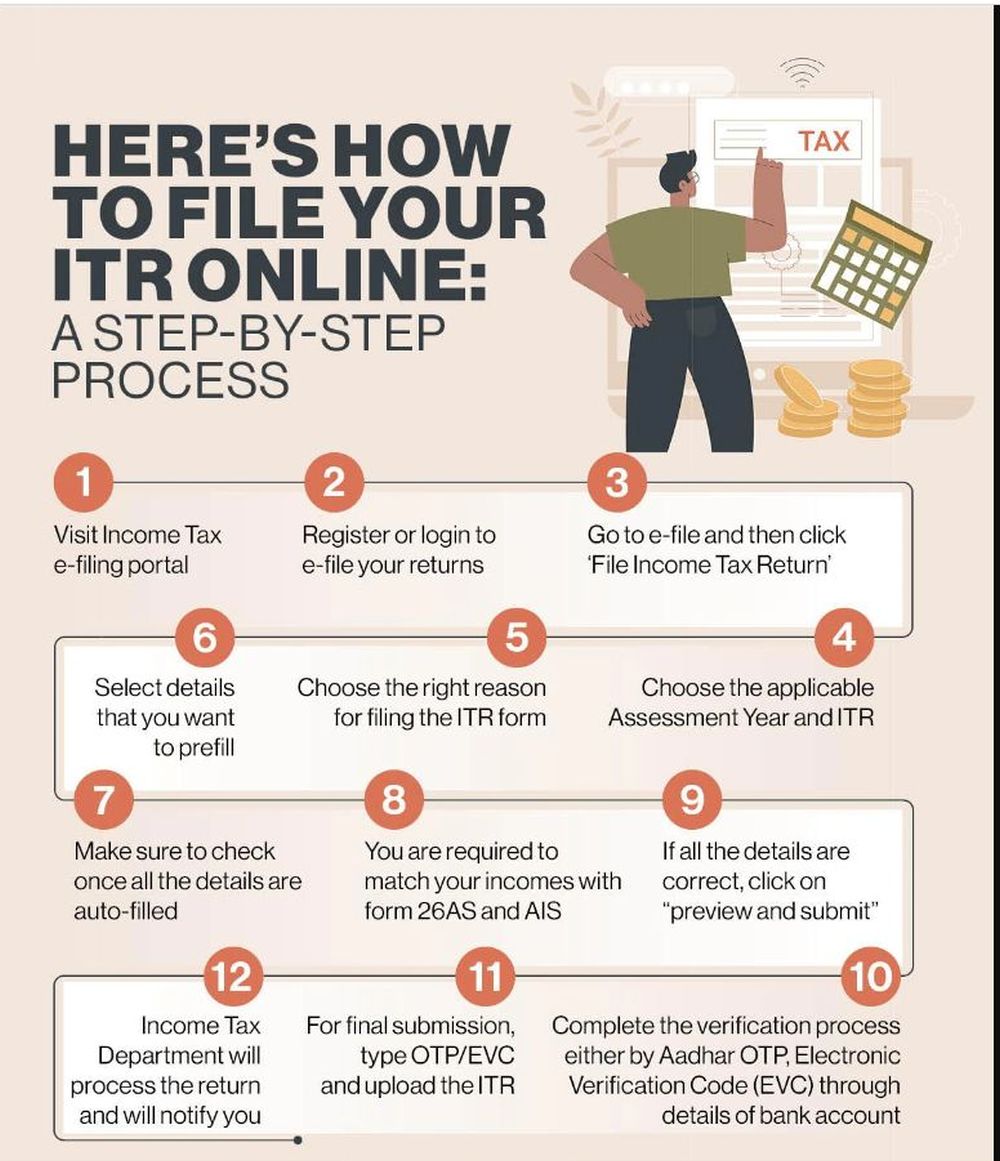

Filing an Income Tax Return (ITR) in India can be done online through the Income Tax Department’s e-filing portal. The ITR1 form is applicable to... Read More

Income Tax

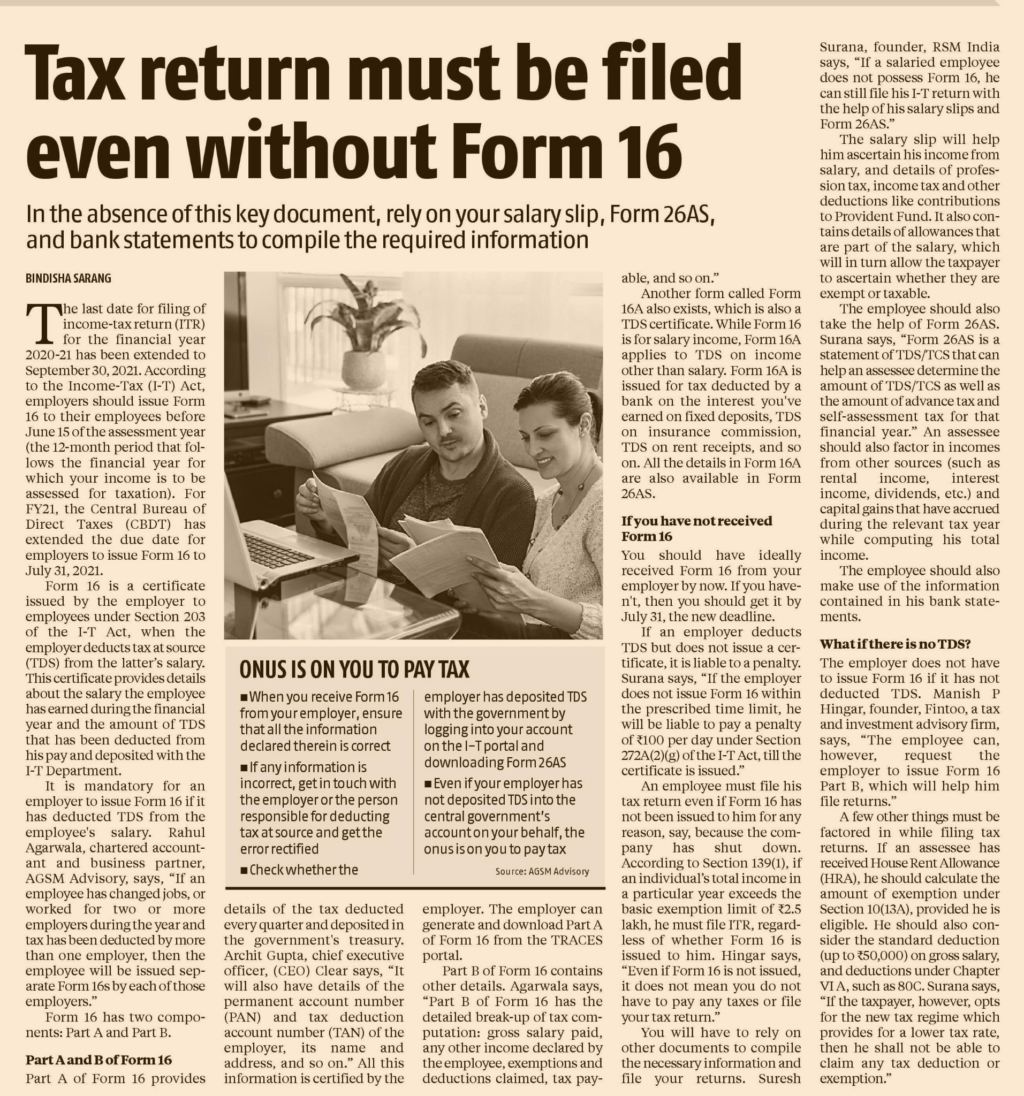

Filing tax returns without Form 16 can be challenging. Without it, calculating accurate income becomes difficult, proving TDS deductions becomes problematic, and claiming deductions accurately becomes a challenge. However, you can take several remedies. Start by communicating with your employer and requesting Form 16. If that fails, escalate the matter internally and send written reminders. If all else fails, approach tax authorities for assistance. In the absence of Form 16, use alternative documents like salary slips and bank statements to calculate income. Maintain proper documentation and consult a tax professional for guidance. Remedies include urging your employer, escalating internally, communicating in writing, seeking assistance from tax authorities, using alternative documents, and maintaining proper records.... Read More

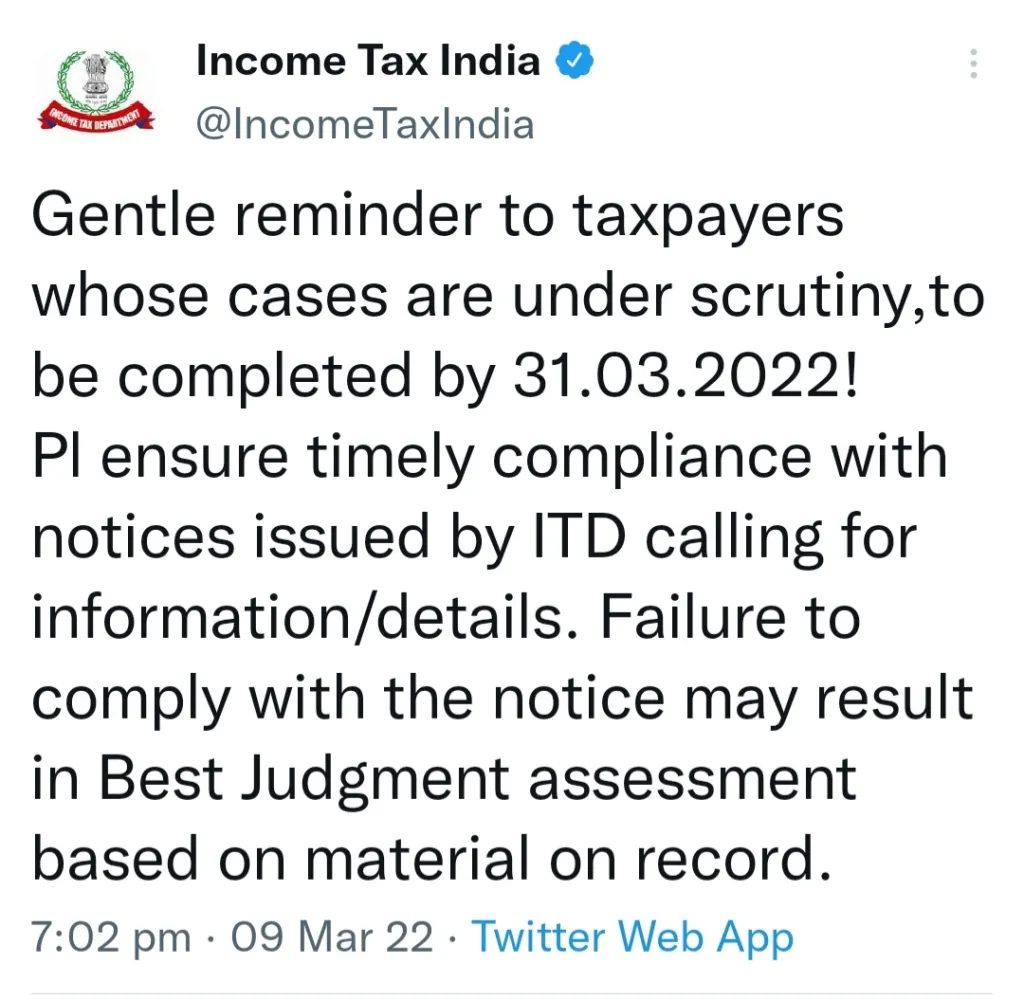

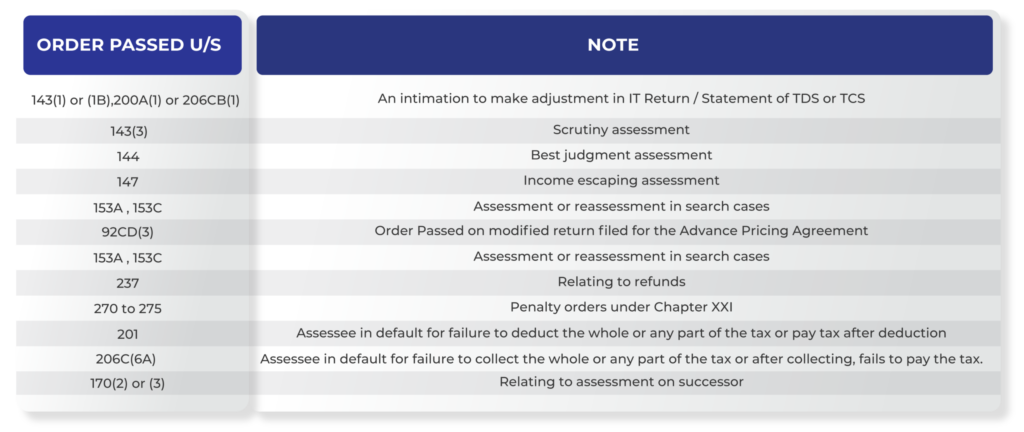

Not replying to queries from the Income Tax Department in India can have various consequences, as the department has the authority to enforce compliance with... Read More

After filing an Income Tax return in India, there are several common reasons why an assessee (taxpayer) may receive a query letter from an Income... Read More

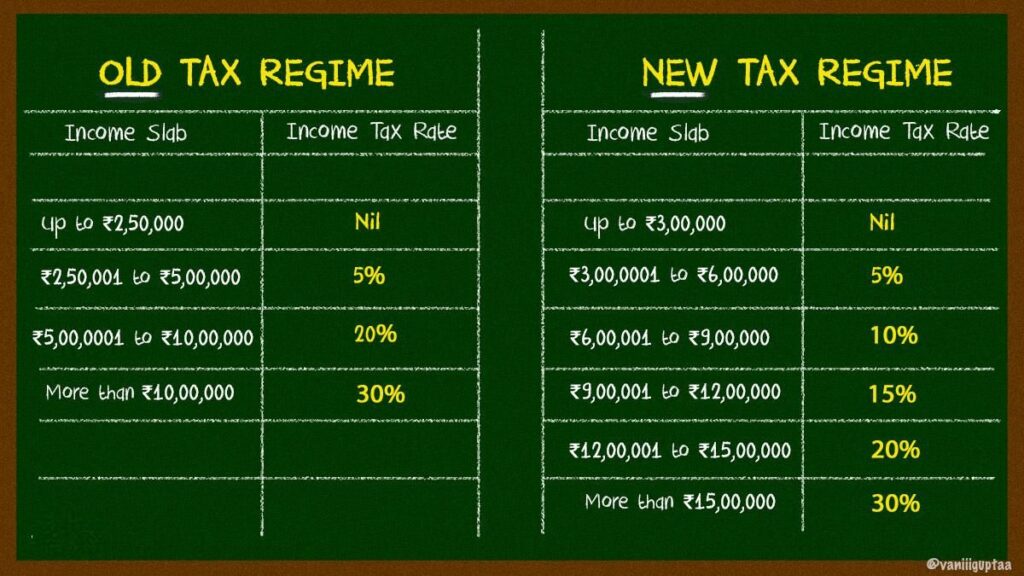

All about Choosing between New Tax Regime and Old Tax Regime- Which regime is good for you

7 min read

All about Choosing between New Tax Regime and Old Tax Regime- Which regime is good for you

7 min read

The New Regime and Old Regime of income tax in India represent two different tax structures that individual taxpayers can choose from. Let’s delve into... Read More

The government announced the new ITR form for the fiscal year on March 31, 2021. The ‘ITR’ is a form used by taxpayers to record... Read More

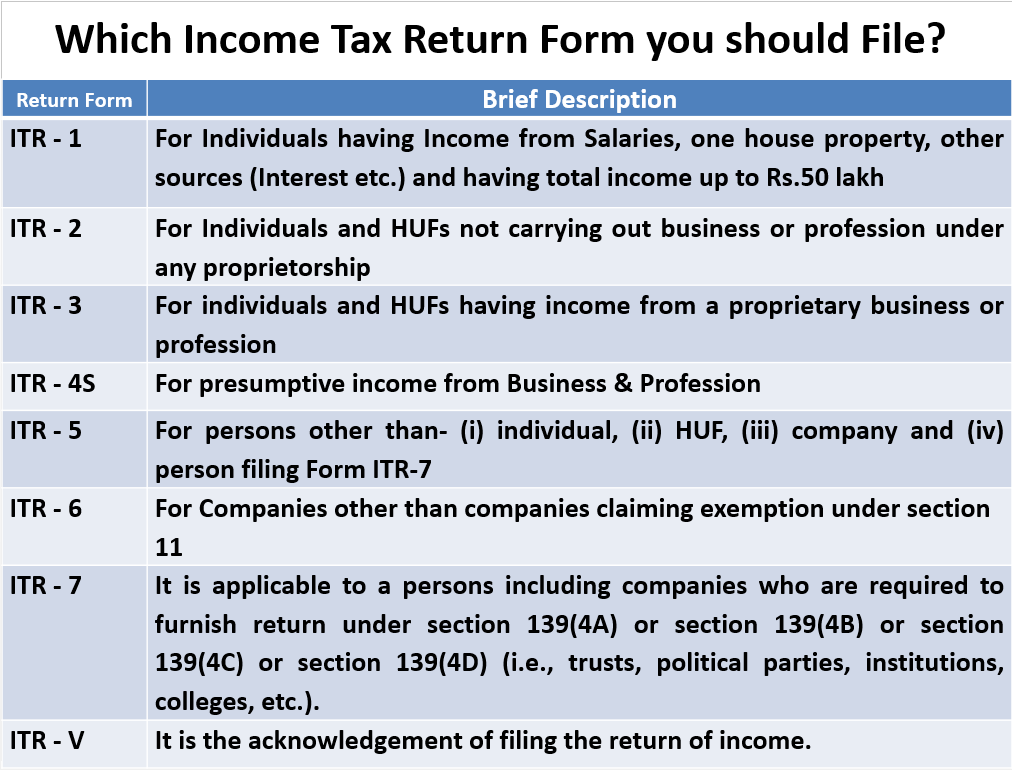

How to select the ITR form to be filed? By Filing return in wrong format, you may miss report some income and get exposed to Penalty... Read More

Inappropriate Initiation of a Tax Evasion Case Proceedings by Assessing Officer(AO) u/s 147

3 min read

Inappropriate Initiation of a Tax Evasion Case Proceedings by Assessing Officer(AO) u/s 147

3 min read

In this article, we’ll discuss the tax evasion petition and how the AO, without proper evidence and without being satisfied by the documents, decided to... Read More

Do you get confused between the terms’ tax evasion and ‘tax avoidance? If yes, you are at the right place to know the difference between... Read More

Tax evasion is unlawful action where an individual willingly tries to escape paying the true amount of tax imposed on him. Intentionally not paying taxes... Read More

Step by Step Guide to file Income Tax Return in ITR1 format- Tax Planning Strategies

Step by Step Guide to file Income Tax Return in ITR1 format- Tax Planning Strategies  How to file Income Tax Return without having received form 16 and what are limitations

How to file Income Tax Return without having received form 16 and what are limitations  What would be Consequences of not Replying to Queries by Income Tax Department India

What would be Consequences of not Replying to Queries by Income Tax Department India  Common reasons that Assessee may get query letter from Income Tax officer after filing Income Tax Return

Common reasons that Assessee may get query letter from Income Tax officer after filing Income Tax Return  What are changes in the income tax return form to be filed this year?

What are changes in the income tax return form to be filed this year?  Which is the Best return form for you to File Income Tax return?

Which is the Best return form for you to File Income Tax return?  What is Tax Avoidance and How it is Not Same as Tax Evasion?

What is Tax Avoidance and How it is Not Same as Tax Evasion?  What are the Causes of Tax Evasion and Ways to Control It?

What are the Causes of Tax Evasion and Ways to Control It?  What is Income Tax Liability on Income from trading in Future and Options

What is Income Tax Liability on Income from trading in Future and Options  The Importance of Filing Your Income Tax Return on Time: A Financial Must-Do

The Importance of Filing Your Income Tax Return on Time: A Financial Must-Do  Is Addition made by Assessing officer on basis of mismatch between AIR and F26AS Justified

Is Addition made by Assessing officer on basis of mismatch between AIR and F26AS Justified  Salient Changes in the new Income Tax Rules relevant to Assessment Year 2024-25

Salient Changes in the new Income Tax Rules relevant to Assessment Year 2024-25