The ITAT Amritsar ruled that a one-time cash payment exceeding ₹20,000 made before a sub-registrar during property registration does not violate Section 269SS of the Income Tax Act.... Read More

Rajbir Chawla

Income Tax Bill, 2025, set to come into effect on April 1, 2026, expands the scope of search and seizure to include digital spaces. However, these enhanced powers have raised significant privacy concerns and fears of potential misuse by taxation authorities.... Read More

These rewards schemes also have limitations, such as excluding government employees and requiring specific documentation. Despite these limitations, the schemes play a crucial role in enhancing transparency and accountability in the Indian tax system.... Read More

The recent Supreme Court judgment primarily impacts employees terminated for misconduct involving moral turpitude, as it allows employers to forfeit gratuity without requiring a criminal... Read More

This ruling empowers employers to take decisive action against employees whose misconduct involves moral turpitude, without the necessity of a protracted criminal trial. It underscores the importance of integrity in the workplace and provides clarity on the legal framework governing gratuity forfeiture... Read More

The ITB 2025 refines the definition of agricultural income, aiming to close loopholes and ensure that exemptions benefit genuine farmers. According to the bill, agricultural income includes: (Read More...)... Read More

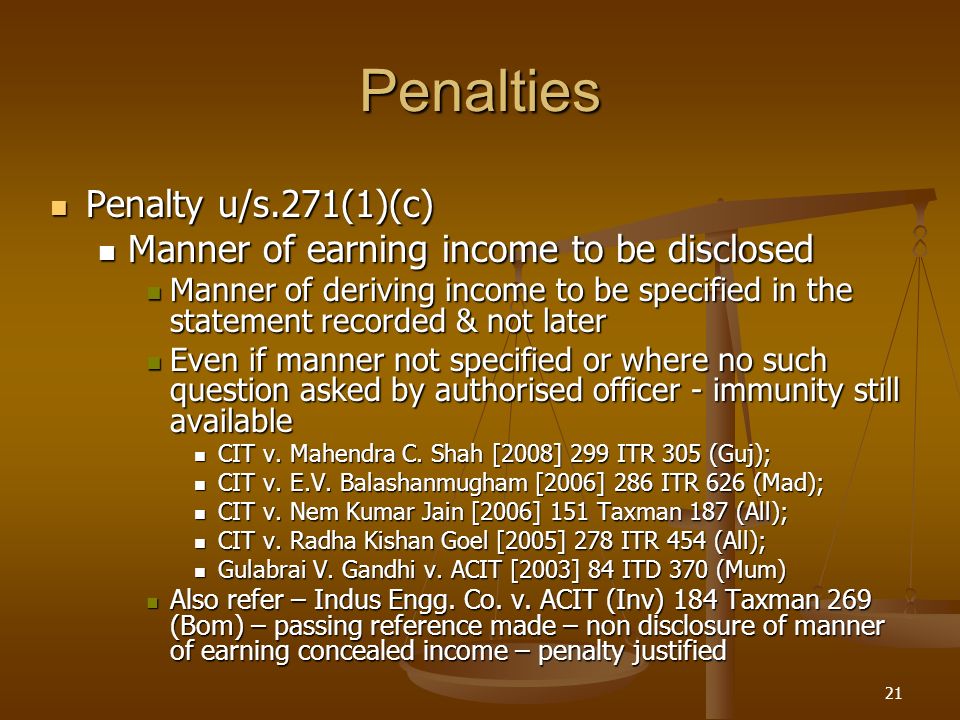

In a recent landmark ruling, the Bombay High Court upheld the imposition of a penalty under Section 271(1)(c) of the Income Tax Act, 1961, on... Read More

Reporting of Foreign Assets by Indian Taxpayers under Section 139(1) of the Income Tax Act

4 min read

Reporting of Foreign Assets by Indian Taxpayers under Section 139(1) of the Income Tax Act

4 min read

As part of introducing transparency in the financial dealings, among various measures introduced over the years the mandatory reporting of foreign assets held by an... Read More

The Direct Tax Code (DTC) 2025 is a significant reform aimed at simplifying India’s complex tax system. It is set to replace the Income Tax... Read More

While there's no specific case law directly addressing this scenario, the general principles of HRA exemption apply. The tax authorities will scrutinize the genuineness of the rent payment and the relationship between the assessee and parents.... Read More

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income  Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure

Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure  Major Changes Expected in Direct Tax Code 2025 and why these matter

Major Changes Expected in Direct Tax Code 2025 and why these matter  Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?

Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?