The Income Tax Appellate Tribunal at Ahmadabad in the case of Dharamshibhai Sonan 22, Kamalpark Row House, Kapodara, Varachha Road, Surat – 395 006 having... Read More

Baisakhi Ganguly

Income Tax implications of Stock Options

3 min read

Income Tax implications of Stock Options

3 min read

What do you mean by a ‘Stock Option’? A stock option is a privilege transferred by one person to another which provides the buyer the... Read More

Presently, works contracts involve three types of taxable activities. As such, different aspects of such activity can be taxed as per different statutes. As the... Read More

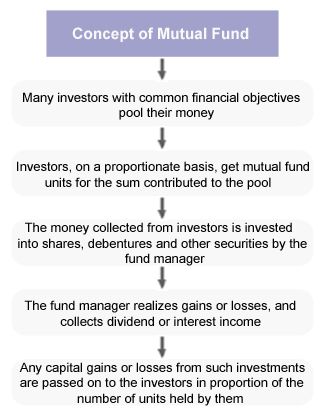

All about Mutual Funds Investments

4 min read

All about Mutual Funds Investments

4 min read

Mutual funds are one of the most common avenues which investors have today. They provide good investment opportunities to the present day investors. Like all... Read More

The Income Tax Tribunal at Mumbai in the case of Lands End Co-operative Housing Society Ltd (having PAN/GIR No. AAAAL 0060C) vs. I.T.O. ward-16(1)(3), Mumbai... Read More

The Income Tax Act, 1961 provides exemption to tax payers from paying income tax on long-term capital gains where the profits of the asset which... Read More

If you are a Non-Resident Indian, you should always be aware of when to pay taxes, how taxes are levied on your income that is... Read More

The Income Tax Tribunal at Kolkata in the case of Soma Rani Ghosh vs. Deputy Commissioner of Income Tax numbered as I.T.A. No. 1420 /Kol./... Read More

The Income Tax Appellate Tribunal, Jaipur in the case of M/s. Gemorium 1969, Dhabaji Ka Khurra, Ramganj Bazar, Jaipur vs. The ITO, Ward- 5(1) Jaipur... Read More

The Income Tax Appellate Tribunal Nagpur in the case of Commissioner of Income Tax vs. Badridas Ramrai Shop, 1939 7 ITR 613 Nag., has held... Read More

Section 50C (1) of the Income Tax Act is retrospective in nature

Section 50C (1) of the Income Tax Act is retrospective in nature  Taxation of Works contracts under Goods and Services Tax

Taxation of Works contracts under Goods and Services Tax  Interest earned by a co-operative society on investments with other societies is entitled to be deducted

Interest earned by a co-operative society on investments with other societies is entitled to be deducted  Mumbai High Court lays strict rules for availing section 54F exemption

Mumbai High Court lays strict rules for availing section 54F exemption  A guide to the benefits enjoyed by a Non- Resident in India

A guide to the benefits enjoyed by a Non- Resident in India  Provisions of Section 194C (6) do not depend upon Section 194C (7)

Provisions of Section 194C (6) do not depend upon Section 194C (7)  No Penalty for bona fide delay in filing tax audit report

No Penalty for bona fide delay in filing tax audit report  Past records of the assessee can be considered in making assessment

Past records of the assessee can be considered in making assessment  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?