There are top reasons where taxpayers get into trouble with the tax authorities. These cases were relatively rare earlier but are now becoming common in the... Read More

Income Tax

- Your guide to understanding and filing income tax returns.

- Simplify your tax filing process with expert advice.

- Learn about the different types of income tax, including individual income tax, corporate income tax, and more. Understand the income tax slabs, deductions, and exemptions applicable to various income sources.

- Get expert advice on tax planning and saving strategies to minimize your tax liability. Learn how to file your income tax return accurately and on time, avoiding penalties and interest charges.

- Stay up-to-date with the latest income tax news, circulars, and notifications. Access useful tools like income tax calculators, TDS calculators, and form 16 download links.

The Central Board of Direct Taxes (CBDT) has cleared the air on taxation on Industrial Leased property Rental Income for letting out industrial leased property... Read More

APPEALS PROCEEDINGS UNDER INCOME TAX ACT, 1961

27 min read

APPEALS PROCEEDINGS UNDER INCOME TAX ACT, 1961

27 min read

The term appeal has nowhere been defined under the Income Tax Act. However as per Mozley and Whiteley’s Law Dictionary “Appeal is a complaint... Read More

Taxmen Following you on Facebook: Be Cautious on Uploading your Holiday Pictures on Facebook

3 min read

Taxmen Following you on Facebook: Be Cautious on Uploading your Holiday Pictures on Facebook

3 min read

It may be a reality with you that you have not paid your taxes in time and went on a holiday or bought a shiny... Read More

In exercise of the powers conferred by 80CCG (1) of the Income-tax Act, 1961 (43 of 1961), the Central Government of India has formulated the ... Read More

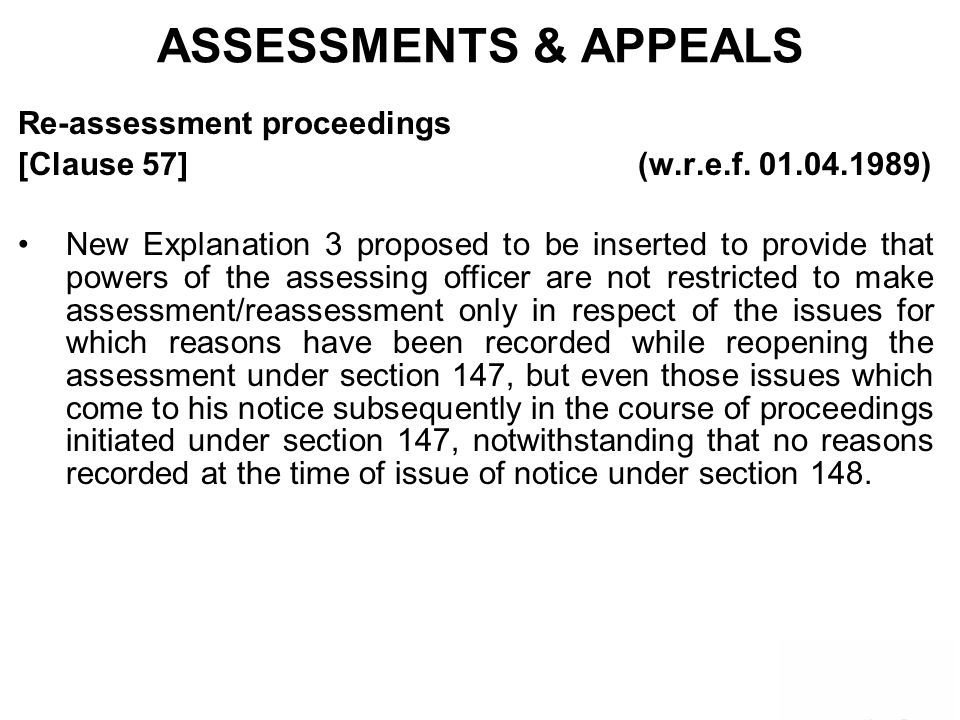

Reassessment is a tool of the Income Tax Department. It gives the Assessing Officer the power to reassess income, of an assessee which has not... Read More

Whether the Receipt of unaccounted Income on sale of agricultural land can be brought in taxation ambit as unaccounted income? The Matter was discussed in following case... Read More

The issue being examined is about the law applicable to sections 269ST and 271DA of the Income-tax Act, 1961. Whether the Penalty U/s 271DA For Violation... Read More

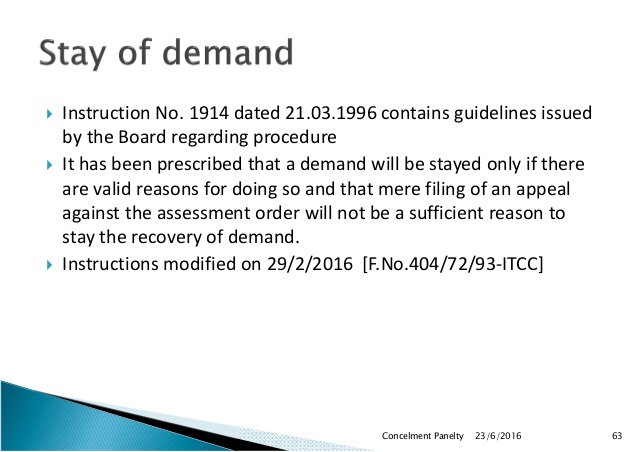

Stay of Demand of Income Tax does not require and Pre-deposit of Tax by Assessee as has been held in following case where the Assessing... Read More

High court has made it clear that will not accept the Delay in filing of appeal by the Income Tax Department. Find out in detail below... Read More

Top Reasons where Taxpayers get into trouble with the Tax Authorities

Top Reasons where Taxpayers get into trouble with the Tax Authorities  Industrial Leased property Rental Income- What is CBDT stand on it

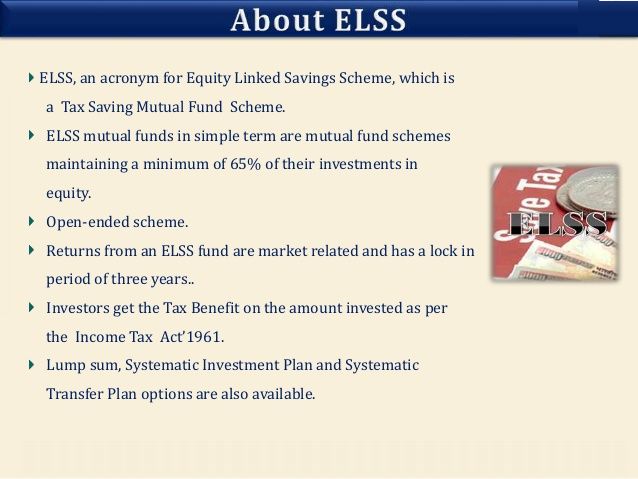

Industrial Leased property Rental Income- What is CBDT stand on it  Merits & Demerits of Investing in Equity Savings Scheme

Merits & Demerits of Investing in Equity Savings Scheme  Receipt of Unaccounted Income due to sale of Agricultural Land is not taxable

Receipt of Unaccounted Income due to sale of Agricultural Land is not taxable  Penalty U/s 271DA For Violation Of S. 269ST Of The Income-tax Act, 1961

Penalty U/s 271DA For Violation Of S. 269ST Of The Income-tax Act, 1961  Stay of Demand of Income Tax by the Assessing Officer does not require an assessee to make a pre-deposit

Stay of Demand of Income Tax by the Assessing Officer does not require an assessee to make a pre-deposit  Delay in filing of Appeal by the Income Tax Department- Not acceptable to the HC

Delay in filing of Appeal by the Income Tax Department- Not acceptable to the HC  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?