Yes, it’s time for the spying eye of the taxman! The last date to file your I-T returns for the year 2018-19 is July 31.... Read More

Diksha Garg

Some of the Best Income Tax Judgements for 2018 that can help plan your income tax liability

4 min read

Some of the Best Income Tax Judgements for 2018 that can help plan your income tax liability

4 min read

Each and every year, numerous judgments have been delivered on the Income Tax Act. Of all these cases, there are a few which have been... Read More

What is section 143(3) of the Income Tax Act? Section 143(3) under the Income Tax Act 1961 refers to the Income Tax Notice pertaining to... Read More

The Department of Income Tax has come up with revised guidelines according to which serious offenses committed under the benami and black money laws are... Read More

The CBDT or Central Board of Direct Taxes has recently suggested some changes in the charitable trusts. A draft notification has been floated to make... Read More

For the Assessment Year 2011-12, the Petitioner NuPower Renewables Pvt. Ltd filed the income return on 29th September 2011, declaring loss of Rs.5.97 Crores (rounded... Read More

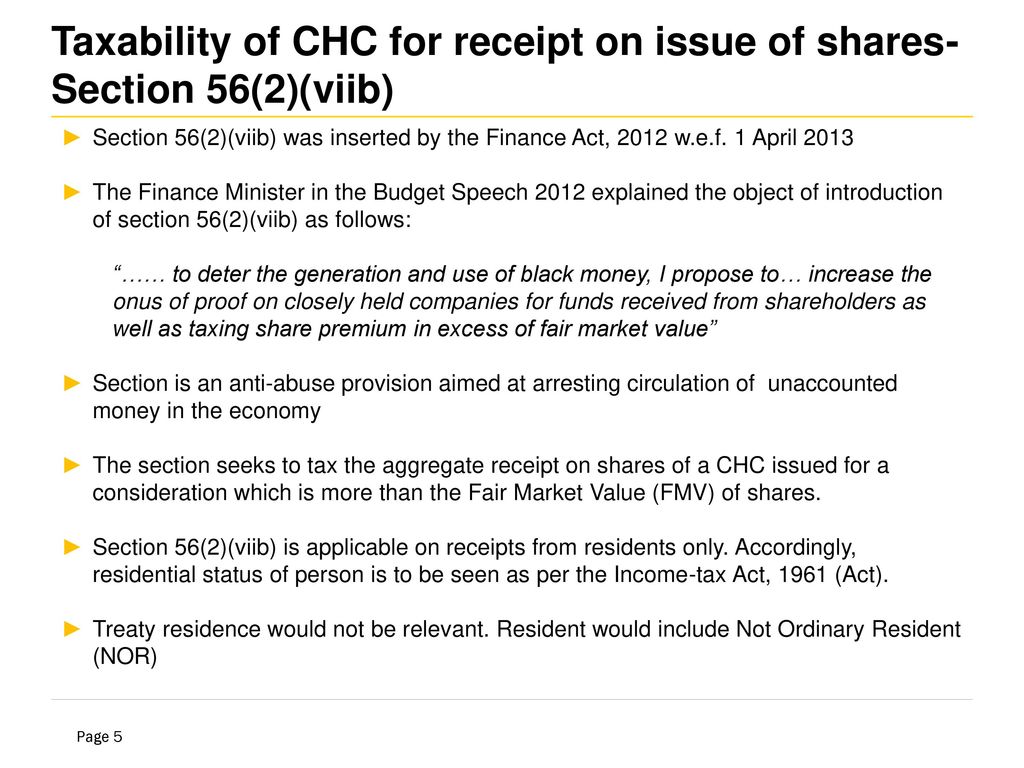

The year 1998 saw the dissolution of the Gift Tax Act which led to the creation of a very dynamic section-Section 56(2) of the Income... Read More

A new format has been notified by the CBDT for Form 16, which is the salary TDS certificate. It would be requiring an in-depth break... Read More

How to avoid long term capital gains tax under section 54 and 54F of the Income Tax Act, 1961? In order to understand how to... Read More

It’s the season of tax filing and yes, the due date for filing of your ITR for the fiscal year 2018-19 is fixed at July... Read More

Failure to file Income Tax Returns: Fine or Jail?

Failure to file Income Tax Returns: Fine or Jail?  Prerequisites for Reopening of assessment beyond a period of 4 years

Prerequisites for Reopening of assessment beyond a period of 4 years  Tax Evaders can escape by paying penalty? New CBDT Norms state otherwise!

Tax Evaders can escape by paying penalty? New CBDT Norms state otherwise!  What are the Proposed Changes about Charitable Trusts?

What are the Proposed Changes about Charitable Trusts?  The Chase on Notional Income widens, but the loopholes prevail!

The Chase on Notional Income widens, but the loopholes prevail!  Fudging income, tax breaks gets tougher with the New Format of Form 16

Fudging income, tax breaks gets tougher with the New Format of Form 16  Tax Queries on tax deductions pertaining to Long Term Capital Gains and SIPs

Tax Queries on tax deductions pertaining to Long Term Capital Gains and SIPs  Filing Taxes In India FY 2018-19: Guidelines for the NRI’s

Filing Taxes In India FY 2018-19: Guidelines for the NRI’s  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?