Learn how to know your online income tax refund status

Do you want to know your income tax refund status? This issue is faced by most of the tax payers in India. People file their income tax return but when they claim their income tax refund, nobody knows what happens after that.

Do you want to know your income tax refund status? This issue is faced by most of the tax payers in India. People file their income tax return but when they claim their income tax refund, nobody knows what happens after that.

For many years people keep waiting for their refund, but are not sure when they will get it back. Though theoretically they should get the refund within a few months, but in many cases they wait for long. But you can check your income tax refund status online and accelerate the process of getting it back.

Different kinds of Income tax refund Status:

(i) Change in address – Many income tax refunds get dispatched at due time, but they return for the change in address. Many people find their refund cheque returned due to “change in address” reason stated in the status.

(ii) Cheque Encashed Status – In case someone has already encashed his refund cheque received from the income tax department, he should get the message “Cheque Encashed” in the status column. But in case you see this but did not receive the cheque, you have to ask for further information regarding the issue.

There can be other refund status depending upon the situation.

How to track the refund status online?

The basic thing you require is your PAN number and the assessment year for which you applied for the tax refund.

What you have to do is visit the official website http://tin.tin.nsdl.com/oltas/refundstatuslogin.html. Then you have to enter your PAN number and select the Assessment Year for which you applied for the refund. Finally you have to click “submit”.

You can also check your refund status by asking the help desk of SBI.

An alternative way to check status – by applying through RTI:

If you think that only knowing your online status is not of much help and you want to be clearer about your refund status, you can file an application under the Right to Information Act, 2005 (RTI) against the income tax department. Such issues can be solved within a very short time of filing a RTI application.

But you should wait for at least one year before applying a RTI against the income tax department. The RTI application needs to be addressed to the concerned officer.

First of all ask for the name, designation, official address and contact number of the officer who will process your income tax refund claim.

You can ask for the exact time period for which the refund is pending along with the reasons for such delay. Ask for the certified copies, if any.

You can ask for the name, designation and address of the higher officer before whom you can file an appeal against such delay.

In many cases there are practically no justified reasons for delay. The delay is due to negligence. Remember only the aggrieved person can file the RTI application, none else can do so on his behalf.

Moreover one should know that the income tax refund is valid only in case the income tax return has been filed on time. If you have made any delay in filing your income tax return, you will lose the interest on the refund amount. Filing an online return results in getting the tax refund faster than in case of offline filing.

What is Income Tax Liability on Income from trading in Future and Options

What is Income Tax Liability on Income from trading in Future and Options  The Importance of Filing Your Income Tax Return on Time: A Financial Must-Do

The Importance of Filing Your Income Tax Return on Time: A Financial Must-Do  Is Addition made by Assessing officer on basis of mismatch between AIR and F26AS Justified

Is Addition made by Assessing officer on basis of mismatch between AIR and F26AS Justified  Salient Changes in the new Income Tax Rules relevant to Assessment Year 2024-25

Salient Changes in the new Income Tax Rules relevant to Assessment Year 2024-25  To What limit can you hold Gold at Home-Taxation on Sale of Gold

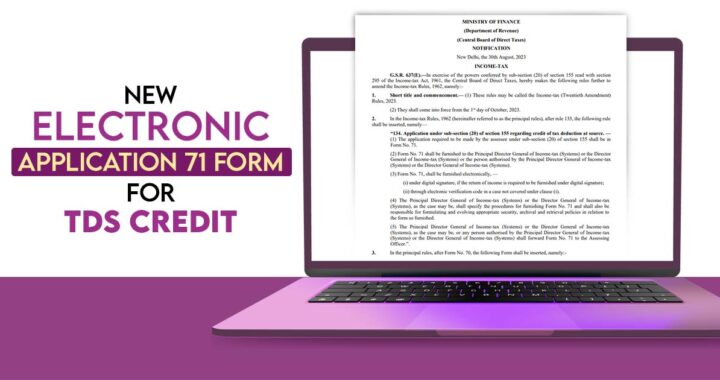

To What limit can you hold Gold at Home-Taxation on Sale of Gold  Claimimg TDS Credit in Previous year while deductor deposited in subsequent year- Use of Form 71- Its benefits and Limitations

Claimimg TDS Credit in Previous year while deductor deposited in subsequent year- Use of Form 71- Its benefits and Limitations