It has been a common norm for free supply of goods and services before their official introduction into the market. This includes the free sample... Read More

input tax credit

Do I pay Input Tax Credit in Goods and service tax? How do I and when can I claim it back?

3 min read

Do I pay Input Tax Credit in Goods and service tax? How do I and when can I claim it back?

3 min read

What is Input credit tax (ITC)? Recently the Government of India has combined all the taxes and made it into single Goods & service tax... Read More

The Goods and Services Tax or GST has been launched on the 1st of July, this year and it is set to change the process... Read More

In an attempt to make possible a full-fledged and flawless credit throughout the complete supply chain under a common tax base, the Goods and Services... Read More

This is in continuation to our Demands and recovery under Model GST Act quick walk through; here we would share a quick guide for the Recovery... Read More

Demand and Recovery under GST Act (Model Version) are basically laid down for the department, for providing them a framework in order to raise a demand on non-payment of... Read More

Here we talk about one of the many aspects i.e. Input Tax Credit (ITC) as a part of the Model GST Law that has been... Read More

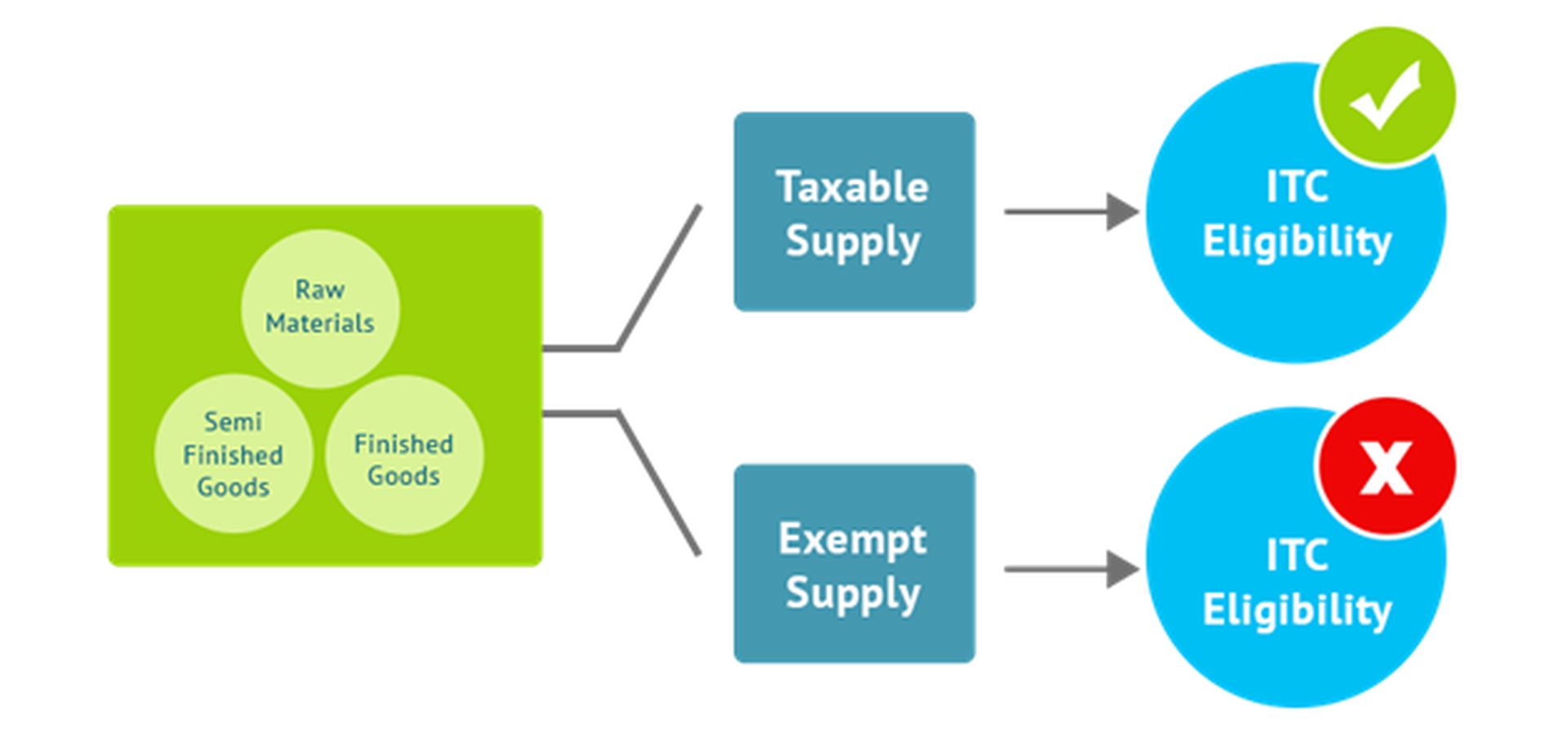

Understanding Input Tax “Input tax” means the {CGST and IGST}/{ SGST and IGST} paid on any goods or services which are used or will be... Read More

All about Taxation under GST

4 min read

All about Taxation under GST

4 min read

The much-awaited Goods and Services Tax has recently becomes a law with President Pranab Mukherjee signing it after ratification by 16 states. With the placement... Read More

What Is The GST Liability on Free Supply of Goods and Services?

What Is The GST Liability on Free Supply of Goods and Services?  Some FAQs about GST- Understanding Scope and Provisions of GST

Some FAQs about GST- Understanding Scope and Provisions of GST  How the System of Input Tax Credit in Goods and Services Tax (GST) being introduced affect your business

How the System of Input Tax Credit in Goods and Services Tax (GST) being introduced affect your business  Demand and Recovery under Model GST Act- A Quick Walk Through- Part II

Demand and Recovery under Model GST Act- A Quick Walk Through- Part II  Demand and Recovery under GST Act – A Quick Walk Through

Demand and Recovery under GST Act – A Quick Walk Through  Key aspects of Input Tax Credit under Model GST Law

Key aspects of Input Tax Credit under Model GST Law  Input Tax Credit on Inputs sent to Job-worker for Job-work under GST Rules

Input Tax Credit on Inputs sent to Job-worker for Job-work under GST Rules  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?