There are some consequential amendments made in the IT provisions by the CBDT about the expenditure and payments. The changes will be relevant from October... Read More

Income Tax

- Your guide to understanding and filing income tax returns.

- Simplify your tax filing process with expert advice.

- Learn about the different types of income tax, including individual income tax, corporate income tax, and more. Understand the income tax slabs, deductions, and exemptions applicable to various income sources.

- Get expert advice on tax planning and saving strategies to minimize your tax liability. Learn how to file your income tax return accurately and on time, avoiding penalties and interest charges.

- Stay up-to-date with the latest income tax news, circulars, and notifications. Access useful tools like income tax calculators, TDS calculators, and form 16 download links.

What are Major Changes with Faceless Assessment? Will it Actually Help Taxpayers or Add Any Woes?

2 min read

What are Major Changes with Faceless Assessment? Will it Actually Help Taxpayers or Add Any Woes?

2 min read

Every administrative department of the government is on the road to digitalization. Old practices are now being done online to achieve efficiency, and optimally utilize... Read More

With the increase in instances of transactions in higher denominations, the Income Tax Department is working in solidarity with other government departments to trace those... Read More

The taxpayers have always expressed their concern over the power vested with the assessing officers, which in many cases has led to corruption and harassment.... Read More

It is necessary to understand the basic terms related to income tax: What is Capital Gain? The Excess income from the sale or exchange of... Read More

According to Section 45(2) of the IT Act, when an assessee converts a capital asset into stock-in-trade of his business, it is considered as a... Read More

The contribution of salaried employees towards the overall tax collection is quite significant owing to their large numbers. Allowances and deductions allow them to reduce... Read More

Should you be Investing in an Annuity?

2 min read

Should you be Investing in an Annuity?

2 min read

An annuity is one of the stipulated tax-saving tools that allow one to reduce his taxable income, and further the tax liability. However, lower returns,... Read More

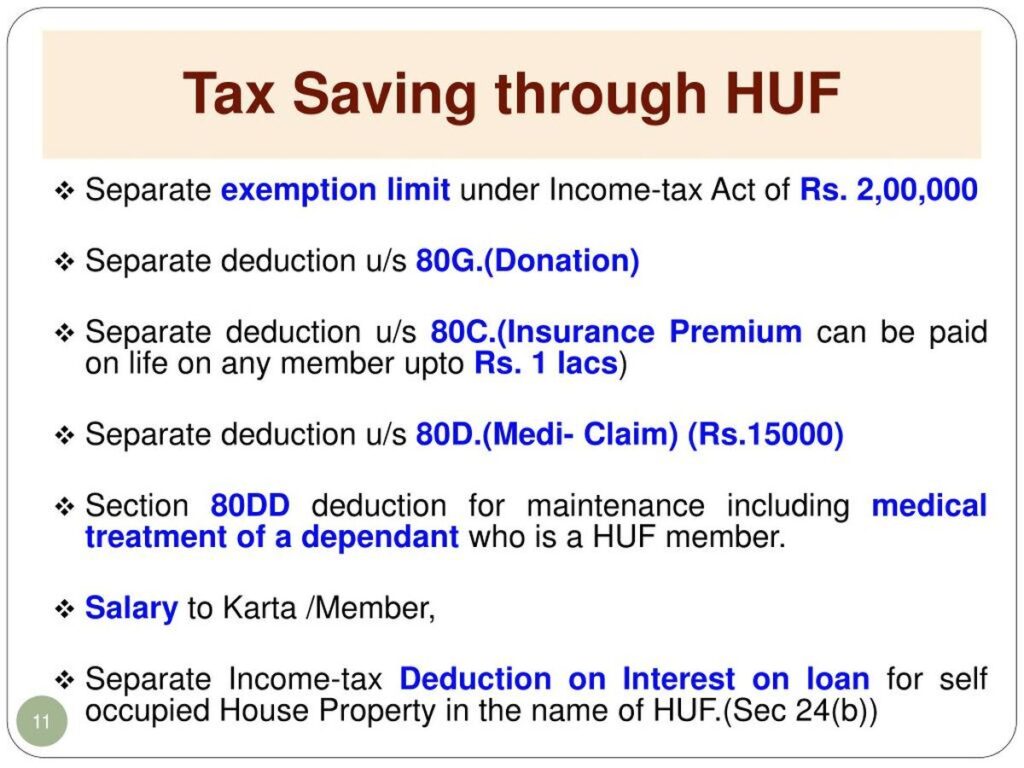

Check how you can use HUF as a tool of tax planning and how to make a HUF Creation deed... Read More

if you are investing more than 175,000 in various items eligible for deduction, you must stick to Old Tax Regime, New Tax regime is only good for those, who do not intend to invest in any tax saving option... Read More

Revised Rules for Income Tax Provisions Applicable From October 2020

Revised Rules for Income Tax Provisions Applicable From October 2020  What High Value Transactions are Reported to the Income Tax Department?

What High Value Transactions are Reported to the Income Tax Department?  Adjust Capital Gains Against Basic Exemption Limit to Reduce Income Tax

Adjust Capital Gains Against Basic Exemption Limit to Reduce Income Tax  Capital Gain in Conversion of Capital Asset into Stock in Trade

Capital Gain in Conversion of Capital Asset into Stock in Trade  Allowances, Exemptions and Deductions under Income Tax Act for Salaried Individuals

Allowances, Exemptions and Deductions under Income Tax Act for Salaried Individuals  Create HUF to save tax and Other Important Aspects of HUF Under Income Tax, 1961

Create HUF to save tax and Other Important Aspects of HUF Under Income Tax, 1961  Which is Better Old vs New Income Tax Regime?

Which is Better Old vs New Income Tax Regime?  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?