What are the Career Opportunities available for a CA post qualification? Do CAs face any Problem in settlement? Share it here

Career Opportunities for a CA

Career Opportunities for a CA post qualification

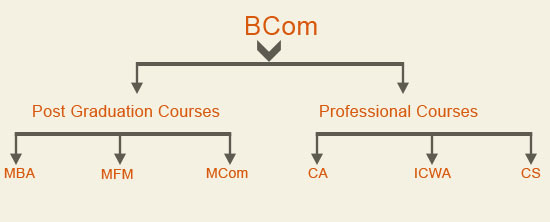

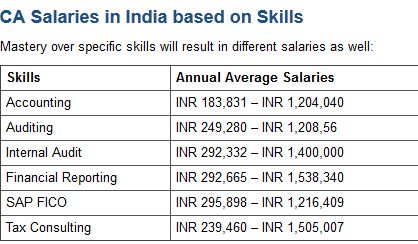

CA – Chartered Accountancy is a progressive and promising profession playing an appreciable role in each and every segment of National and International economy. In the current scenario, Chartered Accountants are considered Business Solutions Providers and not only experts in Accountancy, Audit and Taxation. Career Opportunities for a CA are great….Ranging from Risk Management advisory services CA Practice or serving in an Industry.

Whatever it maybe – Management, Consultancy, Risk Management, Corporate Governance, Strategic Management, Information System Audit, Business Planning and so on – presently there is no field where Chartered Accountants have not carved a niche for themselves.

The dynamics of work, reputation, ofcourse and let us not forget the financial reward, are making it even more promising among the emerging young generation. The demand for CAs is increasing at a commendable rate.

The newly qualified CAs are getting absorbed in the industry in large numbers. The roles and compensations in each industry are different but does not stop anyone in landing up with a job with good return. The Institute from which a student pursues the degree offers campus placement opportunities for newly qualified professionals then there is off campus placements and besides all this self-practice opportunity also exists.

Here is a list of opportunities for a CA post qualification:

| S.No. | Career Opportunity (Industry) | Earning Potential (Industry Average) | Skills Required |

| 1. | Banking | 5-7 lakhs p.a. | 1) Analysis and compliance filing

2) Good communication skills for client facing |

| 2.

|

Big 4s (Statutory, Internal Audit, Tax, M&A) | 6-8 lakhs p.a. | 1) Expertise in particular domain (statutory audit or Internal Audit)

2) Scepticism and communication skills |

| 3. | CA Firms (Compliance and Advisory) | 4-6 lakhs p.a. | 1) Relevant experience in domain

2) Problem solving skills 3) Thorough knowledge of taxation 4) Presentation skills |

| 4. | CA-Practice (Earnings depends on whether you are starting from scratch or join an already established firm) | 7-12 lakhs p.a. (initially as fixed cost of setting an office is huge) | 1) Connections

2) Basic knowledge of every field (mainly compliance related) 3) Patience |

| 5.

|

PSUs

(Position is generally Management Trainee) |

8-12 lakhs p.a. (varies from sector to sector) | 1) It might be possible that you know nothing about the sector you will be working, as they provided training

2) Basic knowledge of all subjects |

| 6. | Software Companies (Profiles are functional consultant, Business Analyst) | 4-7 lakhs p.a. | 1) Basic Accounting, finance and taxation knowledge

2) Journal Entries 3) Experience in ERP, SAP and Tally |

| 7. | Educational Institutes | 3-5 lakhs p.a. | 1) Thorough knowledge of any one subject

2) Earlier teaching experience will definitely help |

| 8. | Finance and Accounts | 5-10 lakhs p.a. | 1) Proficiency in Accounting Standards

2) Expertise in MS-Excel |

All the above figures are estimated averages on the basis of past years’ recruitment trends including both on campus and off campus drives. If on one side there are fresh CAs who are paid less then there are others as well who are paid even 2 times more than the average. It solely depends upon the candidate and his performance.

At the time of any interview whether it is on-campus or off-campus knowledge, experience and good communication skills matter. It depends on how good you convince the interviewer that you are perfect for the job offered however people having all those qualities also get rejected at times but that does not mean you are less than any other Chartered Accountant.

Not all CAs opt for a job or a practice, many CAs are also earning a lot by not doing traditional CA related work. Some of those people are CA Shekhar Kapur (Judge of India GOT talent Season 1 and director of Mr. India and many films), CA Prannoy Roy (Founder and Executive Chairman of NDTV), CA Sanjay Subrahmanyan (Singer), CA Amit Arora (All India Radio and News anchor at Doordarshan) and there are many more who are making their efforts every day to be something.

Problems coming in way to Chartered Accountant to start his career-

There are numerous problems that come while one is to establish as a CA. Some of them are-

- During the Practical training few CA students actually get to appear before an assessing officer to represent a case. Once they are in independent practice, once they seem to struggle during initial period

- Though Institute of Chartered Accountants provides good support, its placement wing needs to be much more stronger

- There is rampant undercutting while quoting fee to a client to get business

- In an zeal to minimize the tax liabilities, often CAs have to face aggressive client who measures his performance only as a factor of tax saved ignoring all tax laws and its long term implications. In the initial years, many CAs find it difficult to stand up it

Are you a CA or a CA Student? What are the problems being faced by you? What assistance do you need to establish yourself? Share your views in comments below

Bankruptcy Lawyer in Pittsburgh

Bankruptcy Lawyer in Pittsburgh  3 Ways to Get Help With Your Legal Case

3 Ways to Get Help With Your Legal Case  Guide to preparing for CA Final Exams – Part 2

Guide to preparing for CA Final Exams – Part 2  Guide to preparing for CA Final Exams – Part 1

Guide to preparing for CA Final Exams – Part 1  MBA and ICWA- Both has its own significance. Which one is good for career- MBA or ICWA?

MBA and ICWA- Both has its own significance. Which one is good for career- MBA or ICWA?  How Much You Can Earn As A Cost and Works Accountant?

How Much You Can Earn As A Cost and Works Accountant?  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?