How to use E-Nivaran Facility of Income Tax?

3 min read

How to use E-Nivaran Facility of Income Tax?

3 min read

Many people face many problems regarding e-filing, refund, and rectification issues, and wish to complain regarding the same to the IT department. But, thinking that... Read More

Revised Rules for Income Tax Provisions Applicable From October 2020

Revised Rules for Income Tax Provisions Applicable From October 2020  What are Major Changes with Faceless Assessment? Will it Actually Help Taxpayers or Add Any Woes?

What are Major Changes with Faceless Assessment? Will it Actually Help Taxpayers or Add Any Woes?  What High Value Transactions are Reported to the Income Tax Department?

What High Value Transactions are Reported to the Income Tax Department?  Adjust Capital Gains Against Basic Exemption Limit to Reduce Income Tax

Adjust Capital Gains Against Basic Exemption Limit to Reduce Income Tax  Capital Gain in Conversion of Capital Asset into Stock in Trade

Capital Gain in Conversion of Capital Asset into Stock in Trade  Allowances, Exemptions and Deductions under Income Tax Act for Salaried Individuals

Allowances, Exemptions and Deductions under Income Tax Act for Salaried Individuals  Should you be Investing in an Annuity?

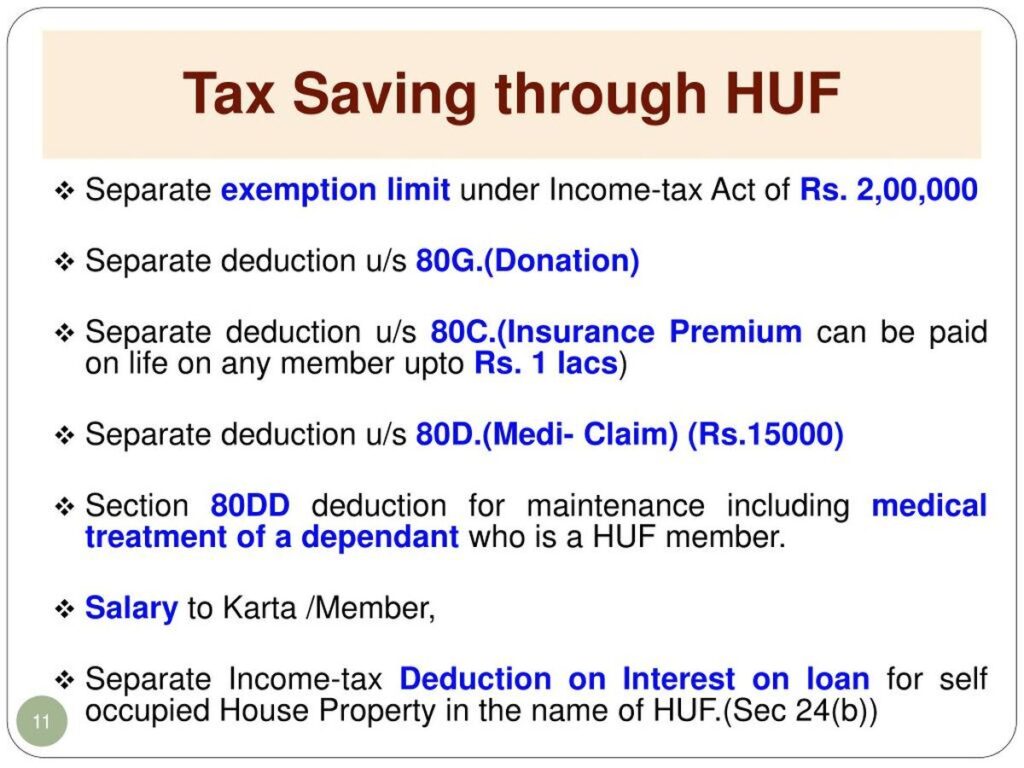

Should you be Investing in an Annuity?  Create HUF to save tax and Other Important Aspects of HUF Under Income Tax, 1961

Create HUF to save tax and Other Important Aspects of HUF Under Income Tax, 1961  Boost Your Business & Reduce Taxes: A Guide to Maximizing Benefits Under Section 80JJAA

Boost Your Business & Reduce Taxes: A Guide to Maximizing Benefits Under Section 80JJAA  What is remedy to taxpayer if the Tax deductor fails to deposit the TDS or fails to file TDS Return

What is remedy to taxpayer if the Tax deductor fails to deposit the TDS or fails to file TDS Return  What is Income Tax Liability on Income from trading in Future and Options

What is Income Tax Liability on Income from trading in Future and Options  The Importance of Filing Your Income Tax Return on Time: A Financial Must-Do

The Importance of Filing Your Income Tax Return on Time: A Financial Must-Do