Penalty for Professional Misconduct of Chartered Accountants

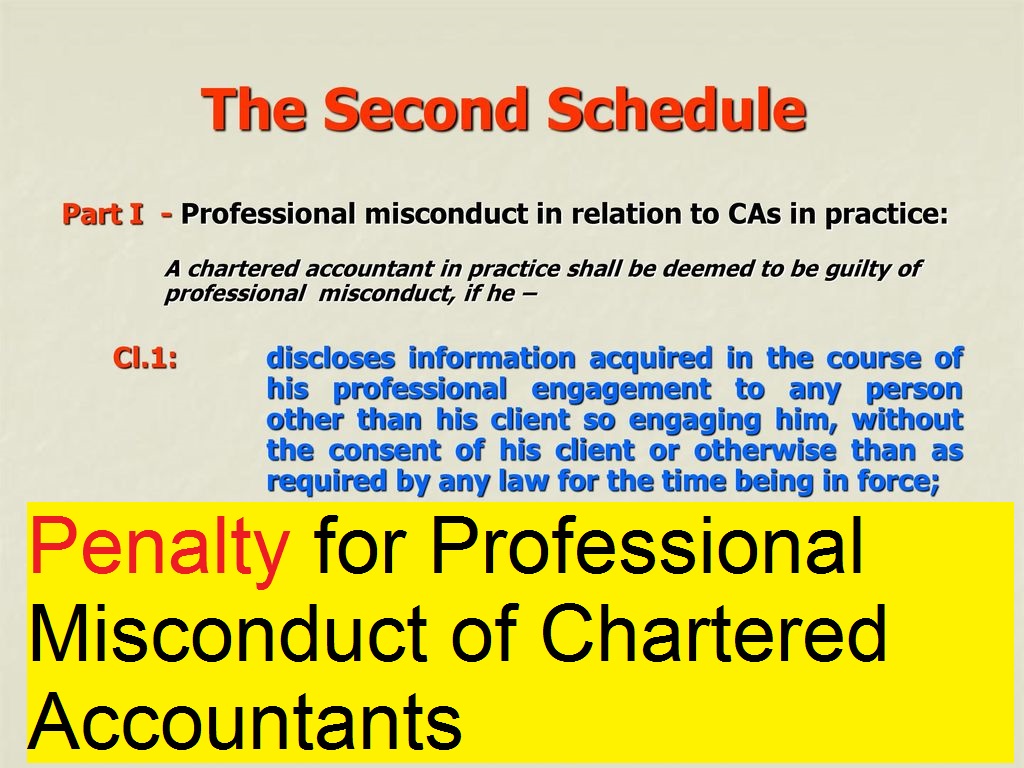

A chartered accountant in practice shall be deemed to be guilty of professional misconduct, if he – Cl.1: discloses information acquired in the course of his professional engagement to any person other than his client so engaging him, without the consent of his client or otherwise than as required by any law for the time being in force;

Any conduct or action by a Chartered Accountant that brings disrepute to the profession or the Institute is regarded as misconduct even if it’s not related to professional work. So the government has planned a Penalty for Professional Misconduct of Chartered Accountants.

The penalty for Professional Misconduct of Chartered Accountants

Case: Council of the ICAI appellant(s) versus Shri Gurvinder Singh &ANR. Respondent(s)

As per the High Court in the given case the respondent (Shri Gurvinder Singh ) while dealing with the complainants was acting as an Individual which was absolutely a commercial transaction. The respondent was not acting or discharging any function as a CA while selling the shares held by him.

Judgment: The judgment was in favor of the respondent. Here the High Court did not impose any penalty on the respondent and granted him leave.

An appeal was made on the basis of the complaint dated 16.03.2005 against Gurvinder Singh, who is a CA, relating to the sale of 100 shares in 1999, which were transferred to the Chartered Accountant’s own name.

Observations of the disciplinary committee of the Chartered Accountant of India:

The disciplinary committee of the Chartered Accountant of India took up the case and observe that the actions of the Respondent (Gurvinder Singh) who himself is a CA is derogatory in nature and highly unacceptable. Under the Sec 22 read with Sec 21 of the Chartered Accountants Act, 1949 the committee held him responsible for the other misconduct.

Recommendations:

It was recommended to the High Court by The Council of the Institute of Chartered Accountants of India to eliminate Gurvinder Singh for a period of six months from the rolls. The council said that the court set aside section 21 and 22 of the Chartered Accountants Act, 1949 while giving the judgment.

The council further added that the court has not taken into consideration Section 21(3) of the Chartered Accountants Act, 1949 which says :

Where on receipt of any such information by, or of a complaint made to it, the Council is of the opinion that any member of the Institute has been guilty of any professional or other misconduct under the first schedule or the second schedules or the both, the Council should take the case to the Disciplinary Committee.

Schedule-I Part-IV says:

A chartered Accountant being the member of the Institute whether in practice or not shall be held guilty of other misconduct if:

(a)The council is of the opinion that his action whether professional or not has brought disrepute to the profession and the Institute.

(b) )Any criminal or civil court penalizes him for an illegal act which is punishable with the imprisonment for a maximum time period of six months;

On the basis of the facts, the disciplinary committee held Gurvinder Singh, a CA, guilty of a practice which is not in the professional capacity of a Chartered accountant.

The Supreme Court (bench comprises Navin Sinha J and Rohinton Fali Nariman J.) said that the judgment given by the High court is incorrect and should be kept aside. It returned the matter to the lower court for reconsideration and further added that however, both the parties are open for all the contentions.

Accordingly, the appeal is taken into consideration.

Major Changes Expected in Direct Tax Code 2025 and why these matter

Major Changes Expected in Direct Tax Code 2025 and why these matter  Steps to Take After a Personal Injury: A Comprehensive Guide

Steps to Take After a Personal Injury: A Comprehensive Guide  ITAT Held AO Cannot Examine Issues in Scrutiny Assessment Except for those Selected for Limited Scrutiny as per the CBDT Circular

ITAT Held AO Cannot Examine Issues in Scrutiny Assessment Except for those Selected for Limited Scrutiny as per the CBDT Circular  Do I Need An Attorney Oklahoma Probate Process?

Do I Need An Attorney Oklahoma Probate Process?  Introducing and predicting the future of DOT

Introducing and predicting the future of DOT  Process to Correct the PAN Card Online

Process to Correct the PAN Card Online  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?