CBDT notifies revised form for Declaration under Income Declaration Scheme

S.O. 2705(E).— In exercise of the powers conferred by sub-section (1) and sub-section (2) of section 199 of the Finance Act, 2016 (28 of 2016), the Central Board of Direct Taxes, makes the following rules further to amend the Income Declaration Scheme Rules, 2016 (hereinafter referred to as the principal rules) namely:-

- (1) These rules may be called the Income Declaration Scheme, (Second Amendment) Rules, 2016.

(2) These rules shall come into force from the date of their publication in the Official Gazette.

- In the principal rules, in rule 4, in sub-rule (5), after the words “submission of proof of”, insert the words “full and final”.

- In the principal rules, in Form-2, after the table, for the portion beginning with the words “The declarant is hereby directed” and ending with the words “shall be deemed never to have been made.” the following shall be substituted, namely:-

“The declarant is hereby directed to make the payment of sum payable as per column (5) of the above table, as specified below:-

(i) an amount not less than twenty-five per cent. of the sum payable on or before 30th day of November, 2016;

(ii) an amount not less than fifty per cent. of the sum payable as reduced by the amount paid under clause (i) above on or before 31st day of March, 2017;

(iii) the whole of the sum payable as reduced by the amount paid under clause (i) and (ii) above on or before 30th day of September, 2017.

In case of non-payment of the amount as specified above, the declaration under Form-1 shall be treated as void and shall be deemed never to have been made.”

- In the principal rules for Form-3, the following Form shall be substituted, namely:-

“INTIMATION OF PAYMENT UNDER SUB-SECTION (1) OF SECTION 187 OF THE FINANCE ACT, 2016 IN RESPECT OF THE INCOME DECLARATION SCHEME, 2016

THE INCOME DECLARATION SCHEME RULES, 2016

Form 3

[See rule 4(4)]

To,

The Principal Commissioner/Commissioner

……………………………………

Sir/Madam,

- Pursuant to the acknowledgement received from you in Form-2 vide certificate F.No._________ dated _______, the detail of payments made are as under:

form3

form31

VERIFICATION

I ………………………………………………son/daughter/wife of Shri ……………………………… hereby declare that the income related to TDS/TCS for which credit is claimed has been included in the income declared in Form-1 and credit of such TDS/TCS has not been claimed earlier. I further declare that I am furnishing the information in my capacity as ……………………………(designation) of ………………………………(name of the declarant) and I am competent to furnish the said information and verify it.

Place: …………….. …………………

Signature

Date: …………….. ……………………..

Address of the declarant

……………………………

PAN of the declarant

Note: **Strike off whichever is not applicable

The form is to be furnished on or before the dates notified for making payments under the Scheme viz. 30.11.2016, 31.03.2017 and 30.09.2017.”.

[Notification No. 70/2016, F. No. 142/8/2016-TPL]

Dr. T.S. MAPWAL, Under Secy.

Note : The principal rules were published vide notification number S.O. 1831(E) dated the 19th May, 2016 and amended vide notification number S.O. 2477(E) dated the 20th July, 2016.

Tax Implications by Owning Residential Property by an NRI in India

Tax Implications by Owning Residential Property by an NRI in India  New House is in wife’s Name – Forget about tax-relief from the sale of the house

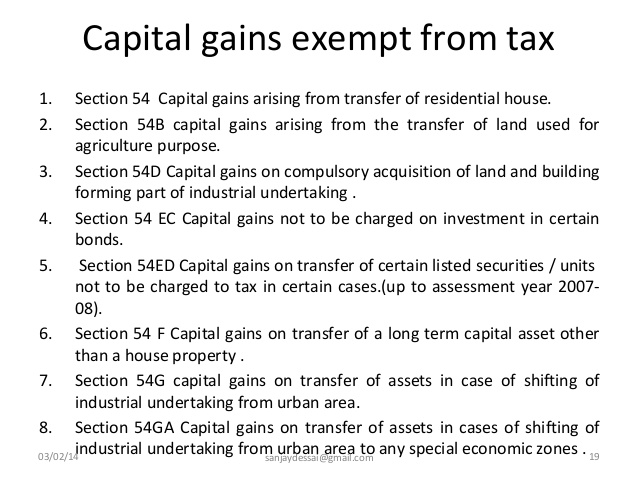

New House is in wife’s Name – Forget about tax-relief from the sale of the house  How can you get tax exemption by selling your asset under Section 54F Income Tax Conditions?

How can you get tax exemption by selling your asset under Section 54F Income Tax Conditions?  Section 80IBA Assures 100% Deduction For Affordable Housing Projects

Section 80IBA Assures 100% Deduction For Affordable Housing Projects  How to Minimize Tax Liability with House Rent Allowance

How to Minimize Tax Liability with House Rent Allowance  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?