No TDS on withdrawals of EPF till covid-19 persists

No TDS on withdrawals of EPF till covid-19 persists

Considering the financial stress that many salaried individuals might be facing because of covid-19 pandemic, government allowed special provision for withdrawal from Employees’ Provident Fund (EPF) account on 20 March 2020. Since announcement Employees’ Provident Fund organization (EPFO) has processed about 1.37 lakh claims disbursing an amount of about 2.8 billion. The remittances of the moneys have already started taking place.

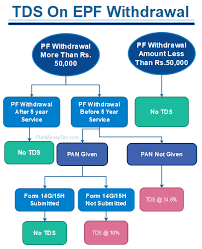

As a rule Funds withdrawn from EPF before completion of 5 years of Service attract TDS

Typically, funds withdrawn from EPF account before the completion of five years of continuous service attract tax, except in certain conditions such as a medical emergency or where the employee or the employer wind up their business or for any other reason beyond the control of the employer. However, even in case you decide to withdraw funds from EPF account because of covid-19 pandemic, such withdrawal will be exempt from tax. Here is how much and how you can withdraw the funds.

How much you can withdraw from EPF?

How to make withdrawal from your EPF Account?

If you want to withdraw funds out of your EPF account, first login to your EPF account using your Universal Account Number (UAN) and password. Once you login, go to online services tab and click on “Claim (Form-31,19,10C & 10D).” You will only be able to proceed further and make claim if you have updated Aadhaar number with your EPF account. In case your Aadhaar is updated with EPF account, it will ask you to enter four digits of your bank account for verification.

After verification of bank account, click on the option “Proceed For Online Claim”. Next is to select the applicable form for withdrawal i.e. Form 31 from the drop down list. If you are withdrawing fund because of the financial hardship due to covid-19, select the purpose as “Outbreak of pandemic (COVID-19)” from the drop down. Now you are required to enter the amount you want to withdraw and upload scanned copy of cheque and enter your address. Click on “Get Aadhaar OTP” to proceed further, enter the OTP received on Aadhaar linked mobile and submit the request. EPFO is claiming to settle the request in the three working days.

Major Changes Expected in Direct Tax Code 2025 and why these matter

Major Changes Expected in Direct Tax Code 2025 and why these matter  Steps to Take After a Personal Injury: A Comprehensive Guide

Steps to Take After a Personal Injury: A Comprehensive Guide  ITAT Held AO Cannot Examine Issues in Scrutiny Assessment Except for those Selected for Limited Scrutiny as per the CBDT Circular

ITAT Held AO Cannot Examine Issues in Scrutiny Assessment Except for those Selected for Limited Scrutiny as per the CBDT Circular  Do I Need An Attorney Oklahoma Probate Process?

Do I Need An Attorney Oklahoma Probate Process?  Introducing and predicting the future of DOT

Introducing and predicting the future of DOT  Process to Correct the PAN Card Online

Process to Correct the PAN Card Online  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?